Strategies for building savings: Saving money is an important aspect of financial well-being because it provides security and stability. A solid savings strategy is essential whether you’re looking to build an emergency fund, save for a major purchase, or plan for the future. In this article, we will look at step by step simple and effective savings strategies.

Contents

Strategies for Building Savings

We will provide practical tips and guidance to help you achieve your savings goals, from assessing your financial situation to automating your savings and cutting back on expenses. Prepare to take charge of your finances and embark on a path to financial freedom and peace of mind.

Analyze Your Financial Situation

Before you can begin to build your savings, you must first understand your current financial situation. This entails analyzing your income, expenses, and overall financial situation. By thoroughly reviewing your finances, you can identify areas where you can cut back or reduce expenses and allocate funds to savings. Analyzing your financial situation will help you effectively implement the strategies for building savings.

Evaluate your income

Total your monthly income from all sources, including your salary, investments, and side hustles. Consider any income fluctuations or irregularities and how they may affect your savings potential.

Analyze your expenses

Examine your bank statements, credit card bills, and receipts to keep track of your monthly expenses.

Divide your expenses into two categories: essential (housing, utilities, groceries) and non-essential (dining out, entertainment).

Identify areas where you can potentially save money by cutting back or reducing expenses.

Assess your debt

Examine your outstanding debts, including credit cards, student loans, and mortgages.

Calculate the interest rates and monthly payments for each debt. Consider debt reduction or elimination strategies to free up additional funds for savings.

Consider your financial goals

- Define your short- and long-term financial objectives, such as saving for a down payment on a home, starting a business, or retiring comfortably.

- Determine the importance and urgency of your goals.

To guide your savings efforts, set specific savings targets for each goal.

Evaluate your overall financial health

Consider your emergency fund, retirement savings, and investments. Check to see if you have enough money saved up for unexpected expenses or financial emergencies. If necessary, seek professional financial advice or consult a financial planner.

You will gain valuable insights into your income, expenses, debt, and overall financial health by thoroughly assessing your financial situation. This foundation will assist you in making informed decisions and developing a realistic savings plan that is in line with your objectives. In the following section, we’ll go over how to make a budget to effectively manage your income and expenses.

Set Clear Savings Goals

Setting clear and attainable savings goals is critical for effectively building your savings. Having specific goals in mind will give you a sense of purpose and motivation to keep going. Here are some steps to help you set specific savings goals:

Define your savings goal

Determine what you want to save for: an emergency fund, a down payment on a house, a dream vacation, or retirement. Be as specific as possible about how much money you want to save and when you want to achieve it.

Break down your savings goal down

Divide your larger savings targets into smaller, more manageable chunks. Set mini-goals that can be completed in shorter periods of time, creating a sense of progress and accomplishment along the way.

Make your goals measurable

Each savings goal should be assigned a specific dollar amount or percentage. This will allow you to track your progress and determine how close you are to achieving each goal.

Review and adjust goal as needed

Reassess your savings goals on a regular basis to ensure they remain relevant and align with your changing financial situation. Make necessary adjustments based on changes in income, expenses, or new financial priorities.

Automate Your Savings

This is one of the important part of the strategies for building savings. Saving money automatically is a powerful strategy that can make it easy and consistent. By establishing automatic transfers or contributions, you eliminate the need for manual actions while ensuring that a portion of your income is consistently directed toward your savings goals.

Here are some suggestions to help you automate your savings:

Determine the amount to save

Refer to your budget and savings goals to determine how much you can comfortably set aside each month for savings. Save a percentage of your income or a fixed amount that corresponds to your goals.

Choose a dedicated savings account

Create a separate savings account for your savings goals. To maximize your savings, look for accounts with competitive interest rates and low fees.

Set up automatic transfers

Set up automatic transfers from your primary checking account to your savings account with your bank or financial institution. Based on your income and budget, select a frequency that works for you, such as monthly, bi-weekly, or weekly.

Review and adjust on a regular basis

Keep an eye on your automated savings and make changes as needed. As your income or financial circumstances change, increase your savings or reduce the frequency of transfers.

You remove the temptation to spend money before it can be saved by automating your savings. This method establishes a consistent and disciplined approach to gradually increasing your savings.

To stay on track, review your savings progress and adjust your automated savings plan on a regular basis. In the following section, we will look at ways to cut back on expenses in order to free up more money for savings.

Cut Back on Expenses

Cutting back on expenses is one of the most effective ways to increase your savings. You can free up more money for your savings goals by identifying areas where you can cut back on your spending.

Here are some strategies to help you save money:

Make a budget

Create a budget outlining your income and expenses. Set spending limits for each category to ensure you stay within your budget and have more money available for savings.

Reduce wasteful spending

Determine where you can make immediate savings, such as dining out, entertainment, or impulse purchases. Consider alternatives to eating out, such as cooking at home or finding free or low-cost entertainment.

Spend less on everyday expenses

Consider meal planning, couponing, or shopping during sales to save money on groceries. Find energy-saving practices, such as turning off lights when not in use or adjusting thermostat settings, to help you save money on your utility bills.

Prioritize your needs

Differentiate between wants and needs to make conscious spending decisions. Focus on fulfilling essential needs while cutting back on discretionary expenses.

Examine your subscription services

Examine your subscriptions and think about canceling or reducing those you no longer require or use frequently. For services such as streaming platforms or gym memberships, look for more cost-effective alternatives or shared plans.

You can create significant savings opportunities by actively cutting back on expenses. Remember to review your spending habits on a regular basis, adjust your budget, and stay focused on your financial goals. In the following section, we will go over strategies for reducing debt and interest payments in order to boost your savings efforts even further.

Increasing Income

Although cutting back on expenses is an effective way to save money, increasing your income can also help to accelerate your savings efforts. Finding ways to increase your earnings allows you to put more money toward your savings goals. Part of the strategies for building savings, this should be top of your list.

Here are some strategies for increasing your income:

Explore side hustles or freelance work

Determine which skills or talents you can use to provide services or freelance work on a part-time basis. Consider tutoring, graphic design, writing, or driving for ride-sharing services as options. List of 32 best online jobs for everyone to find the perfect side hustle for you. You can also read on side hustles from popular blogs online to get an idea of side hustles out there.

Rent out Assets

Consider renting out spare rooms, a second home, or valuable assets to generate extra income. Platforms such as Airbnb and car-sharing services can assist you in monetizing underutilized assets like cars.

Make money from your hobbies or interests

Try ways to turn your hobbies or passions into a source of income. Selling handmade crafts, teaching music lessons, or providing consulting services related to your interests are all possibilities.

Consider part-time or flexible work

Look for part-time or flexible work that fits your schedule. Working evenings, weekends, or remote positions to supplement your income could be an option.

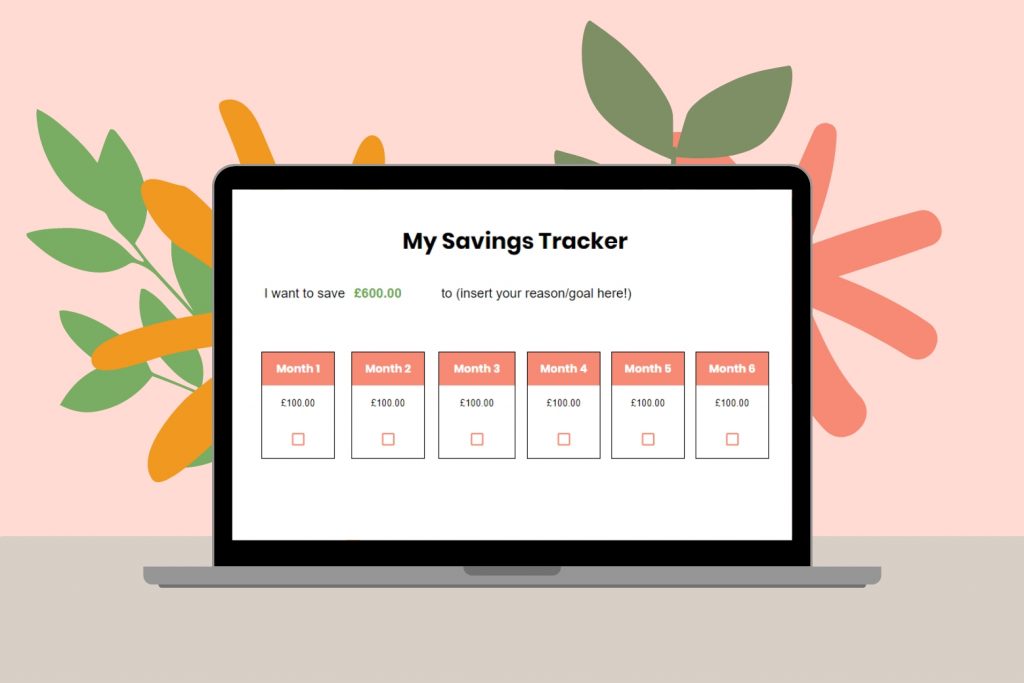

Track Saving Progress and Stay Motivated

Consistency and motivation are required for saving. You can stay on track to meet your savings goals by tracking your progress and staying motivated.

Here are some methods for keeping track of your progress and staying motivated

Establish milestones

Divide your savings targets into smaller milestones. Celebrate each accomplishment to keep motivation and a sense of accomplishment high.

Keep track of your savings

Track your savings progress with a spreadsheet, budgeting app, or online tool. Regularly update and review your savings tracker to see how your savings have grown over time.

Visualize your goal

Use a vision board or a chart to create a visual representation of your savings goals. Display it in a prominent location as a daily reminder of your goals.

Rejoice in small wins

Recognize and celebrate minor victories along the way. As a reward for your progress, treat yourself to something small or engage in a favorite activity.

Look for accountability partners

Share your financial objectives with trusted friends or family members. Check in with them on a regular basis to keep them up to date on your progress and to seek their support and encouragement.

Conclusion

Saving money is an important step toward financial security and achieving your financial goals. You can lay a solid foundation for your savings by implementing simple strategies such as assessing your financial situation, setting clear goals, automating savings, cutting back on expenses, increasing income, and tracking progress.

Remember that saving takes time and effort. Maintain focus on your objectives, track your progress, and celebrate your accomplishments along the way. Maintain your motivation by visualizing the benefits of your savings, seeking inspiration, and enlisting accountability partners to help you.

Take action now and begin implementing these strategies. Whether you’re saving for a down payment on a house, creating an emergency fund, or planning for retirement, every small step counts.

Keep in mind that saving money is about more than just sacrificing; it’s about gaining financial freedom and peace of mind. Begin your journey toward financial success and watch your savings grow.